Don’t Surrender To Tax Treaties

By

Presenting artists from other countries is very exciting. It allows you to provide your audiences an experience they can not get anywhere else in the country. Since the governments of other countries frequently subsidize tours by their resident artists, presenting these performances can be quite affordable. What may not seem so exciting or affordable is resolving the issue of the 30% withholding tax that is assessed against foreign artists, especially when you learn that everyone ...

A Little Bird Told Me: Twitter Analytics

By

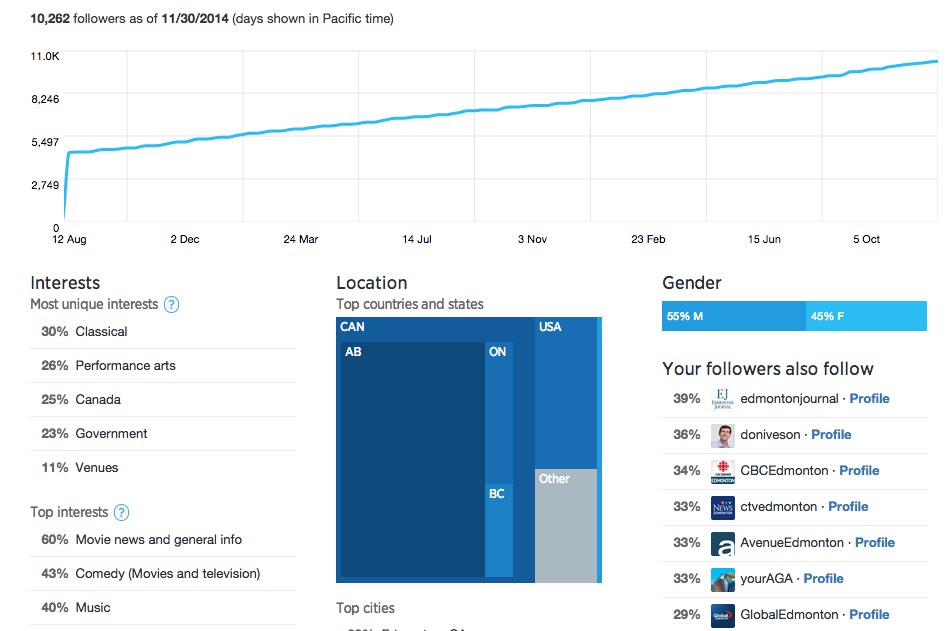

Did you know that you can access analytics about your Twitter followers, impressions and engagement, for free, right in your own profile? Twitter sure doesn’t make it obvious unless you’re already using Twitter ads / promoted tweets. But even if you’re not planning a paid campaign on Twitter, you can still access analytics for organic tweets by “signing up”. You’ll only get impression data for tweets made after you sign up (lack of historical info ...

Get To Know artshacker.com

By

Today marks the launch of artshacker.com, a site dedicated to providing practical tips, tricks, and pointers for getting things done as an arts manager. ArtsHacker is the result of good old fashioned necessity; up until the time of its launch, the field of nonprofit performing arts administration has been awash in a sea of theory and visioning. There are new models aplenty and regardless of their value, they don’t amount to a hill of beans ...

Thank you for the authoritative read on this issue. To me, being able to actually see the icon in the…