If you are like most, you may view the 990 filing for your non-profit organization like you view filing your income taxes–an annoying, burdensome task best handled by an accountant. The difference is, you aren’t obligated to make your personal tax filing available for review by anyone who asks like you are with your organization’s 990.

Given that the 990 filings are available online at sites like Guidestar, you aren’t even necessarily aware of who is looking at your filings. The forms actually tell people a lot about you. One of the primary uses we have focused on around here at Arts Hacker is compensation, but there is a lot more to be gleaned.

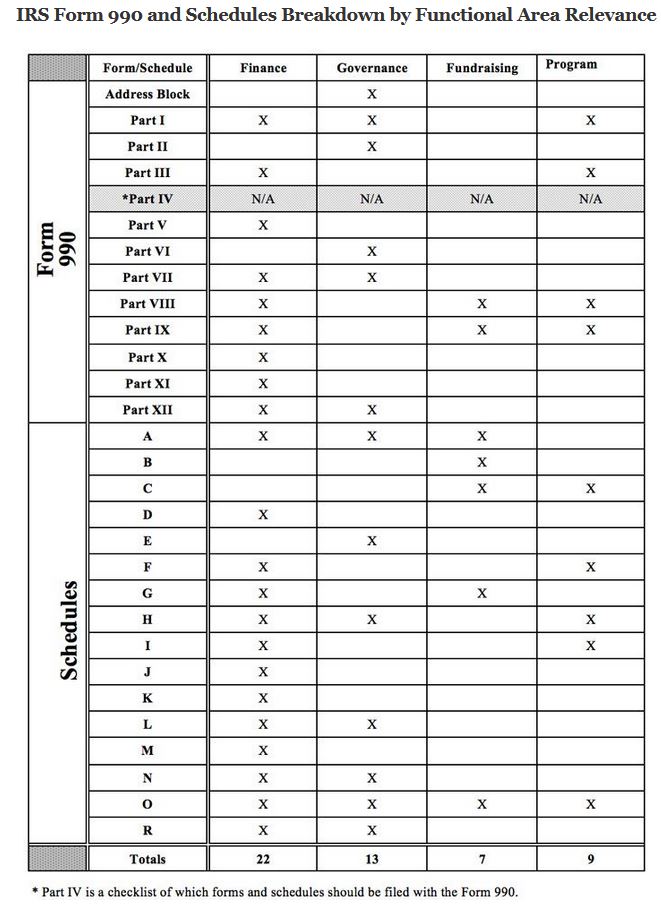

A recent article on Non-Profit Quarterly provides a handy chart that “identifies 51 times the 12 parts of the main Form 990 and the 16 schedules address one or more of the four categories.” The categories being governance, finance, program and fundraising.

The article ends with the warning:

Don’t dismiss the 990 as a requirement for auditors and finance experts to deal with. Nonprofit staffs, boards, donors, and volunteers should be aware that the publicly available return is a public relations tool that communicates governance, program, and fund development information as well as income and expenses, assets and liabilities. In other words, your nonprofit’s 990 is showing. What is it showing and what conclusions are people drawing from the disclosures—or lack of disclosures—within each year’s form?

While they don’t get into specifics about how the 990 might be used, on my personal blog I written about concerns raised by Cindy Lott over the increased ease of access to 990 filings.

One concern Lott had was that people who don’t have standing will use the information as the basis to bring a lawsuit against a non-profit because they feel their interests aren’t being represented by a state attorney general. These may be beneficiaries, marginalized board members, donors, etc. She also mentioned that secretaries of state who enforce consumer protections may equate consumer rights with donor rights.

I am merely noting what may be a natural outcome of the current trajectory of an underresourced enforcement community intersecting with a wealth of publicly available data. We may very well find in the near future that donors and beneficiaries who have access to information about where these billions of dollars are going may, in fact, decide that they would like a say when they believe something goes off the rails.

A few years early, I had written about how the increasing focus on good governance meant the possibility of increased scrutiny by the IRS if the absence of governance related policies were indicated on the 990. Those I cited cautioned against slapdash formulation of policies just to be able to check a box. That advice is doubly true now that it is potentially more than just the IRS taking interest in 990 filings.

An opportunity the 990 affords that your personal tax filing doesn’t is Schedule O where you can attach additional information you think is pertinent. This may be a discussion of changes in operational and philosophical direction that resulted in an atypical shift in your finances. This is also an opportunity to mention any points of pride or information of interest to make a case for your worthiness to those who may be perusing your 990 filing to learn more about your organization.