Introducing ArtsHacker’s Most Creative People In Arts Administration, 2016

By

First and foremost, we want to thank everyone who took the time to submit a nominee for the inaugural Most Creative People in Arts Administration list. Not only were applications full of detail info the panel needed to deliberate, but the individualism and authenticity from each applicant was evident in each submission. Despite all the ups and downs over the course of 2016, it’s reassuring to know that the field has so many creative innovators. Each of their projects reaffirms the value of not only being creative, but knowing how to get things done to bring that creativity to fruition. Hopefully, they’ll serve as inspiration to expand your creativity while accomplishing more than thought was possible in the year to come. The panel results were all very close and when it was all said and done we ended up with a very good problem to have in the form of a tie. As such, we’re very pleased to present both as recipients in our inaugural program.

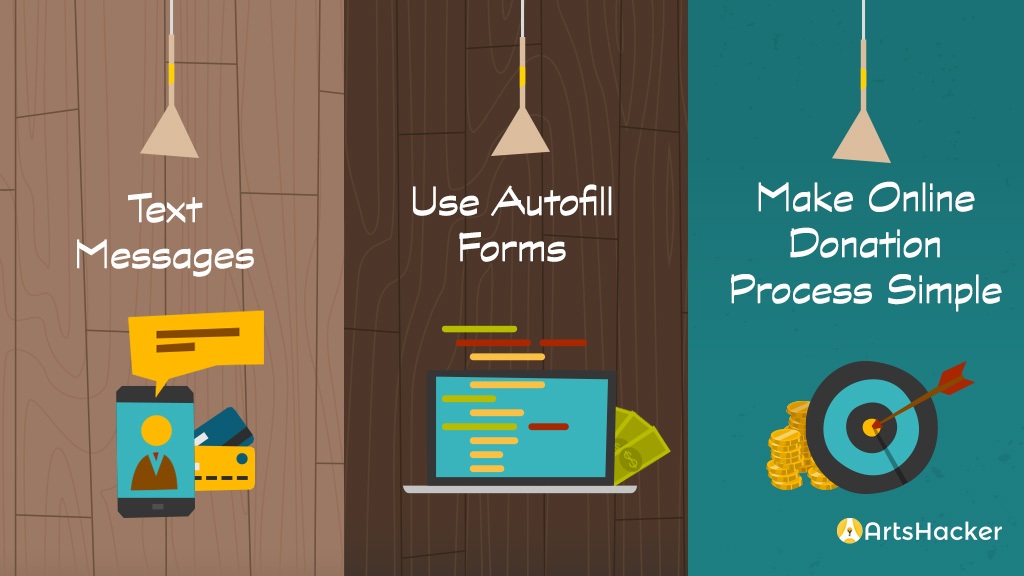

Three Last Minute Tips To Maximize Year-End Giving Campaigns

By

We’re only three days away from the deadline for claiming charitable donations so here are three tips you can use to help maximize donations from procrastinating donors. [box] [dropcap]1[/dropcap]Text Message: this is one of my favorites; according to IRS Publication 526, Charitable Contributions > When to Deduct > Text Message “Contributions made by text message are deductible in the year you send the text message if the contribution is charged to your telephone or wireless …

Thank you for the authoritative read on this issue. To me, being able to actually see the icon in the…