I recently attended a webinar conducted by John Taylor of John H. Taylor Consulting providing updates on IRS rules on acknowledging charitable giving. Neither Taylor nor I are lawyers and there are a lot of subtleties and exceptions when it comes to tax law. There were a number of interesting things Taylor mentioned that are worth being aware of, if only to serve as a conversation starter with your accountants and attorneys. Perhaps the thing to which to most pay attention is the guidance regarding donor advised funds since those are becoming more prevalent.

Acknowledging Donations

Most non-profits are in the practice of providing acknowledgements for donations made to them. Acknowledgements are only required for donations of $250 and above in order to claim a deduction and the donor is responsible for obtaining the acknowledgement. However, the best practice for donor relations is to get that acknowledgment off fairly quickly before the donor asks. For those donations that come at year end trying to beat a December 31 deadline, IRS publication 1771 suggests the receipt cite a received date, but Taylor cites a former head of the IRS and three tax attorneys as saying the date processed is better.

Deducting Benefits

Where things get really interesting is in terms of quid pro quo (QPQ) — when you provide a benefit in return for a donation. Many arts organizations provide things like tickets, gifts, ad space in playbills, invitations to receptions, use of meeting spaces in return for donations and sponsorships. The fair market value of all those benefits needs to be deducted from the value of the donation/sponsorship when acknowledging the donation. Unless the giver refuses the benefits at the time of making the gift, they are deemed to have received the benefit even if they never use it. (i.e. never used season tickets).

The value of every benefit needs to be itemized. However, you don’t need to provide a quid pro quo receipt if the fair market value of ALL benefits does not exceed the lesser of 2% of the gift amount or $111 (as of 2019). You don’t need to list token gifts like keychains, bumper stickers, mugs with your organizational logo on it that you give to donors as long as the fair market value of these things is not worth more than $11.10. UNLESS you are giving these things to people who have given less than $55.50 since $11.10 is less than 2% of that sum.

So basically as Taylor says, the lesson here is not to send out tchotchkes to every person who donates without regard to the amount.

Be Careful With Donor Advised Funds

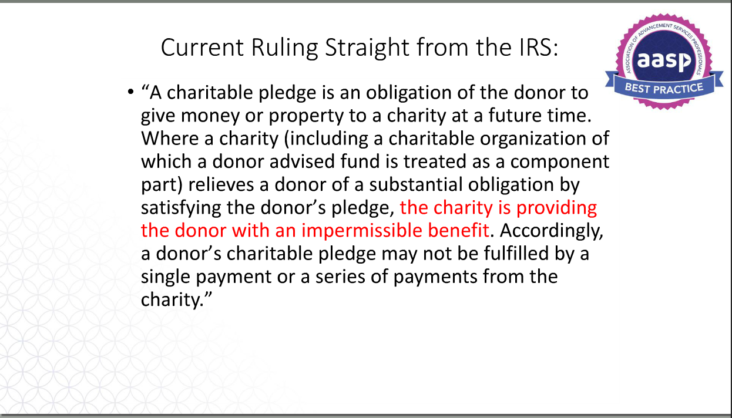

As mentioned earlier, something to be most aware of are is the guidance regarding donor advised funds. Until things are clarified, money from a donor advised fund (as well as many family foundations) can not be used to fulfill a personal pledge.

This slide from Taylor’s webinar explains why:

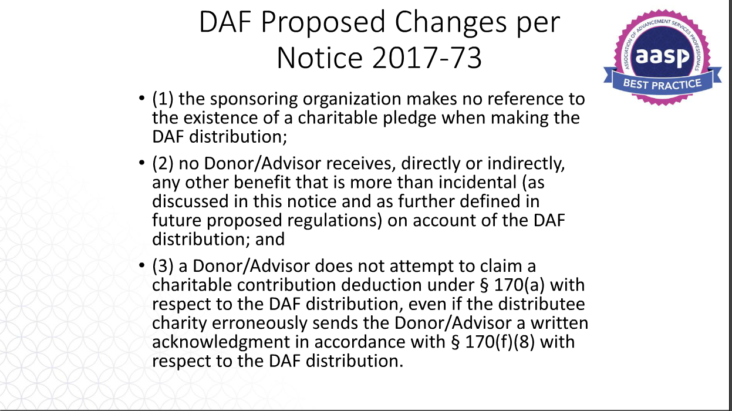

There was a proposed change to this whose comment period ended in March 2018 that would allow donor advised funds to be used to fulfill a pledge. The rule hasn’t been updated and as you can see, it is still rather restrictive and pretty much disallows any sort of benefit. Taylor advises not to invite people who make donations via a donor advised fund to donor receptions, even if you allow them to pay for the value of the reception. Doing so is considered bifurcation by the IRS because you are only allowing them the opportunity to participate based on the donation.

Acknowledging Other Things of Value

The webinar covered dozens of other interesting issues:

For example, a gift is always a gift. You can’t return a gift to an irate donor. You can write a check to them for an amount, but you have to issue a 1099 because it considered taxable income for them.

Providing service like volunteer time, legal services, catering, advertising space, etc is not considered a deductible gift so you can’t issue a receipt. Same with use of space and assets like vacation time share, office space, use of software. According to Taylor, a non-profit needs to be given ownership of something for it to be considered a deductible donation.

Even for those things that a non-profit takes ownership of, how it will be used determines how much of the value is deductible. Auction items, real estate, vehicles, etc that the non-profit will turn around and sell are considered unrelated use and are valued differently than if the home or vehicles will be used by the non-profit in the execution of their mission.

It is best to consult with a lawyer or accountant about how to acknowledge the value of these things because it can get complicated pretty quickly. For example, both the donor of an object for auction and the bidder who knowingly pays more than the value of that item may require an acknowledgment.

It is useful to be aware of all these issues because you’ll know enough to ask for guidance from professionals. Don’t assume your accountant or lawyer is paying close attention to what you are doing and assessing the implications, even if they are serving on your board of directors.

[box type=”alert”]Disclaimer: What is a blog post about a legal topic without a disclaimer? This is not legal advice. You should not be getting your legal advice from a blog post. The purpose of this post is to give you things to think about. Speak to a lawyer about specifics.[/box]